Nearly half of adults aged 65-80 (47%) lack dental insurance, yet maintaining oral health becomes increasingly crucial as you age. This guide walks you through current coverage options, helps you understand cost factors and outlines strategies to access affordable dental care in your golden years. According to research from the University of Michigan, the majority of seniors without dental coverage cite cost as the primary barrier to obtaining insurance.

The Current State of Senior Dental Coverage

Who Has Coverage and Who Doesn’t

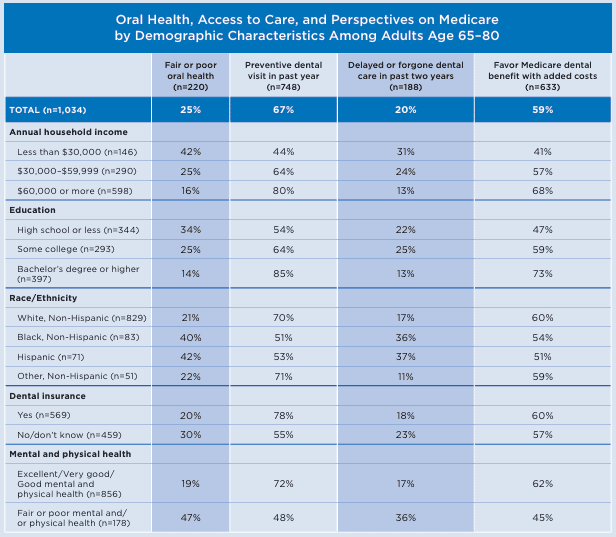

The dental insurance landscape varies dramatically across senior populations:

- Only 53% of adults aged 65-80 have any form of dental insurance

- Coverage decreases with age: 34.3% of adults 65-74 have coverage compared to just 19.9% for those 85+

- Income creates stark disparities: 36.1% of seniors not classified as poor have dental insurance versus only 8.1% of those considered poor

- Ethnicity impacts coverage rates: Hispanic seniors have lower coverage rates (17.5%) compared to non-Hispanic white (30.6%), non-Hispanic Black (28.6%) and non-Hispanic Asian (29.8%) adults, according to CDC data

- Dental status itself affects insurance likelihood: seniors who have lost all their natural teeth (edentate) are significantly less likely to have dental insurance (14.9%) than those with some natural teeth (32.5%)

For covered seniors, insurance sources include:

Try Our Dental Calculators

| Insurance Source | Percentage of Seniors |

|---|---|

| Employer plans | 27% |

| Medicare Advantage | 26% |

| Retiree health plans | 22% |

| Individual plans | 19% |

The Impact on Your Dental Health

Without insurance, many seniors face difficult choices about their oral health:

- 7.7% of adults 65+ reported unmet dental needs due to cost concerns

- One-third of seniors haven’t had a dental checkup in over two years

- 72% of seniors wish they had taken better care of their teeth when younger, according to a Delta Dental survey

- The Health and Retirement Study found that only 66% of older adults had a dental visit during a two-year period, with fully retired persons more likely to have visited a dentist than those still working

These gaps in care contribute to serious oral health issues:

- 68% of older Americans suffer from gum disease

- 30% experience chronic dry mouth

- Untreated dental problems can worsen existing health conditions including diabetes and heart disease

- Poor oral health is linked to malnutrition, as dental problems can make eating difficult and limit dietary choices

- Research published in the Journal of the American Medical Association indicates that seniors with unresolved dental issues are at increased risk for respiratory infections, cardiovascular disease and poorer diabetes control

Your Insurance Options Explained

Original Medicare and the Coverage Gap

If you rely on traditional Medicare (Parts A and B), you’ll find a significant gap in your healthcare coverage:

- Original Medicare does not cover routine dental care, with rare exceptions for dental services that are integral to covered medical procedures

- Medicare Supplement plans (Medigap) typically do not include dental benefits

- This leaves you responsible for 100% of costs for cleanings, fillings, extractions, dentures and other dental procedures

- According to Milliman research, this coverage gap has persisted despite years of policy discussions about expanding Medicare to include dental benefits

- The Commonwealth Fund reports that many seniors on Medicare who lack dental coverage often postpone necessary treatments until they develop into emergencies

Medicare Advantage Plans: A Popular Alternative

Medicare Advantage has become the primary dental insurance source for many seniors:

- As of 2023, 25.5 million Medicare beneficiaries received dental benefits through Medicare Advantage, according to the National Association of Dental Plans

- Most plans cover preventive services like cleanings and exams

- Coverage varies widely between plans for more extensive procedures

- The vast majority of Medicare Advantage plans (94%) offer some form of dental coverage as a supplemental benefit

- Studies show that seniors with Medicare Advantage dental benefits are more likely to receive regular preventive care than those without coverage

When evaluating Medicare Advantage dental benefits, look for:

- Annual coverage maximums (typically $1,000-$2,500)

- Waiting periods for major procedures

- Network restrictions that may limit your choice of dentists

- Copays and coinsurance requirements

- Service frequency limitations (e.g., cleanings covered only every six months)

- Excluded services that might be important to your specific oral health needs

Standalone Dental Insurance

Private dental insurance offers more comprehensive coverage options:

- Plans typically cover 100% of preventive care

- 80% coverage for basic procedures (fillings, extractions)

- 50% coverage for major procedures (crowns, bridges, dentures)

- Investopedia’s research identifies standalone plans as often providing higher coverage limits and more comprehensive benefits than those bundled with Medicare Advantage

Delta Dental’s Premium PPO ranks as the highest-rated plan for seniors, offering:

- $2,000-$2,500 annual benefit maximum

- No waiting period for preventive services

- Large provider network with over 156,000 dentists nationwide

- Coverage for implants and major restorative work

According to Forbes Advisor, other top-rated options for seniors include:

| Provider | Notable Features | Best For |

|---|---|---|

| Aetna | Low premiums, no waiting periods for preventive care | Budget-conscious seniors |

| UnitedHealthcare | Hearing and vision bundle options | Comprehensive coverage |

| Humana | Loyalty programs that increase benefits over time | Long-term value |

| Cigna | No age limits, preventive care covered 100% | Easy approval |

When comparing plans, pay particular attention to coverage for services most needed by seniors, including:

- Periodontal treatments for gum disease

- Root canals and extractions

- Dentures, bridges and implants

- Annual maximums sufficient for potential major procedures

Dental Savings Plans: An Alternative Approach

Dental savings plans offer an insurance alternative with distinct advantages:

- Not insurance but membership programs offering discounts of 10-60%

- Annual fee typically $100-$200

- No waiting periods for most services

- No annual maximums on how much you can save

- Immediate use for most dental procedures

According to Cigna’s research, dental savings plans can be particularly advantageous for seniors who:

- Need immediate dental care (no waiting periods)

- Require expensive procedures that would exceed insurance annual maximums

- Want flexibility in choosing providers

- Are looking for coverage for pre-existing conditions

- Need specialized treatments that might be excluded from traditional insurance

These plans work through pre-negotiated rates with participating dentists. You simply present your membership card at a participating dental office and receive the discount at the time of service. Unlike insurance, you pay the discounted rate directly to the dentist with no claims to file or reimbursements to wait for.

The American Dental Association Health Policy Institute notes that while savings plans don’t provide the same predictable coverage as insurance, they can offer substantial value for seniors needing extensive dental work beyond what insurance would typically cover.

Cost Considerations for Common Dental Procedures

Understanding potential costs helps you evaluate insurance value:

| Procedure | Average Cost Without Insurance | Typical Insurance Coverage |

|---|---|---|

| Routine cleaning | $75-$200 | 80-100% |

| Comprehensive exam | $100-$300 | 80-100% |

| X-rays (full mouth) | $100-$200 | 50-100% |

| Filling | $150-$450 | 50-80% |

| Crown | $800-$1,500 | 50% |

| Root canal | $700-$1,500 | 50% |

| Complete dentures | $1,050-$2,500 | 50% |

| Periodontal cleaning | $120-$200 | 50-80% |

Market Trends Shaping Future Coverage

The dental insurance landscape continues to evolve:

- The global dental insurance market, valued at $170 billion in 2025, is projected to grow at a 9.0% CAGR through 2034, according to industry projections

- Teledentistry is expanding access for seniors with mobility challenges or those in rural areas

- AI-enhanced diagnostics are improving treatment planning and reducing diagnostic errors

- Value-based care models are emerging to better integrate oral and overall health

- Deloitte’s healthcare outlook predicts personalization will be a key differentiator in senior dental coverage by 2027

According to the Amada Senior Care report, key trends include:

| Trend | Impact on Seniors |

|---|---|

| Integration with medical care | Better management of conditions affected by oral health |

| Expanded preventive coverage | Greater emphasis on avoiding costly procedures |

| Technology-enabled access | Remote consultations and monitoring for mobility-limited seniors |

| Personalized risk assessment | Custom coverage based on individual oral health profiles |

| Subscription-based models | Alternatives to traditional insurance with predictable costs |

Innovations in Senior Dental Coverage

Insurance providers are developing new options specifically tailored for seniors:

- Enhanced coverage for preventive services

- Reduced out-of-pocket expenses

- Specialized dental networks with geriatric expertise

- Better integration with overall healthcare

- Innovative payment models that reward preventive care usage

- Henry Schein’s 2025 industry outlook predicts increasing provider adoption of real-time insurance eligibility checks and pretreatment estimates to improve price transparency

- Several providers are piloting programs that increase annual maximums for seniors who receive regular preventive care, creating incentives for maintaining oral health

Strategies to Maximize Your Dental Benefits

To get the most from your dental insurance:

- Prioritize preventive care – most plans cover 100% of checkups and cleanings, which helps prevent costly procedures later. According to Delta Dental Illinois, regular preventive care can reduce overall dental expenses by up to 40% over time.

- Understand your annual maximum and plan treatments accordingly. If you need extensive work, schedule complex procedures across calendar years to maximize coverage.

- Ask about senior discounts – many providers offer reduced rates beyond insurance coverage. The Senior Living guide notes that many practices offer 10-15% courtesy discounts for seniors even with insurance.

- Consider dental schools for lower-cost treatment options. Procedures at dental schools can cost 50-70% less than private practices while still providing quality care supervised by experienced dentists.

- Explore multiple coverage options before making decisions. Research from the Healthy Aging Poll shows that seniors who compare at least three different coverage options report higher satisfaction with their dental benefits.

- Understand network limitations if your plan uses preferred providers. Out-of-network care often results in significantly higher out-of-pocket costs.

- Create a dental savings fund to supplement insurance coverage for major procedures or costs beyond annual maximums.

Quick Review

- Nearly half of seniors lack dental insurance, with coverage declining with age and lower income

- Original Medicare doesn’t cover routine dental care, creating a significant coverage gap

- Medicare Advantage plans offer varying levels of dental benefits to 25.5 million beneficiaries

- Standalone dental insurance provides more comprehensive coverage but with annual maximums

- Dental savings plans offer an alternative with no waiting periods or annual limits

- The dental insurance market is growing at 9% annually, with new options emerging for seniors

- Prioritizing preventive care remains the most cost-effective strategy for maintaining oral health

- Socioeconomic factors significantly impact coverage, with only 8.1% of poor seniors having dental insurance

Your oral health directly impacts your overall well-being and quality of life. According to research published in the Journal of Public Health Dentistry, seniors with poor oral health are more likely to experience nutritional deficiencies, social isolation and reduced quality of life. Taking time to understand your dental insurance options can help you maintain a healthy smile throughout your senior years while managing costs effectively.